The Best Countries for Offshore Investment and Their Financial Advantages

The Best Countries for Offshore Investment and Their Financial Advantages

Blog Article

How Offshore Investment Works: A Step-by-Step Break Down for Financiers

Offshore financial investment offers an organized pathway for investors seeking to enhance their monetary methods while leveraging international possibilities - Offshore Investment. The procedure starts with the cautious option of a territory that aligns with an investor's objectives, followed by the establishment of an account with a reputable offshore organization. This methodical method not only enables portfolio diversification but also demands ongoing monitoring to browse the complexities of worldwide markets. As we discover each action in detail, it ends up being obvious that understanding the subtleties of this financial investment method is crucial for attaining optimum outcomes.

Understanding Offshore Financial Investment

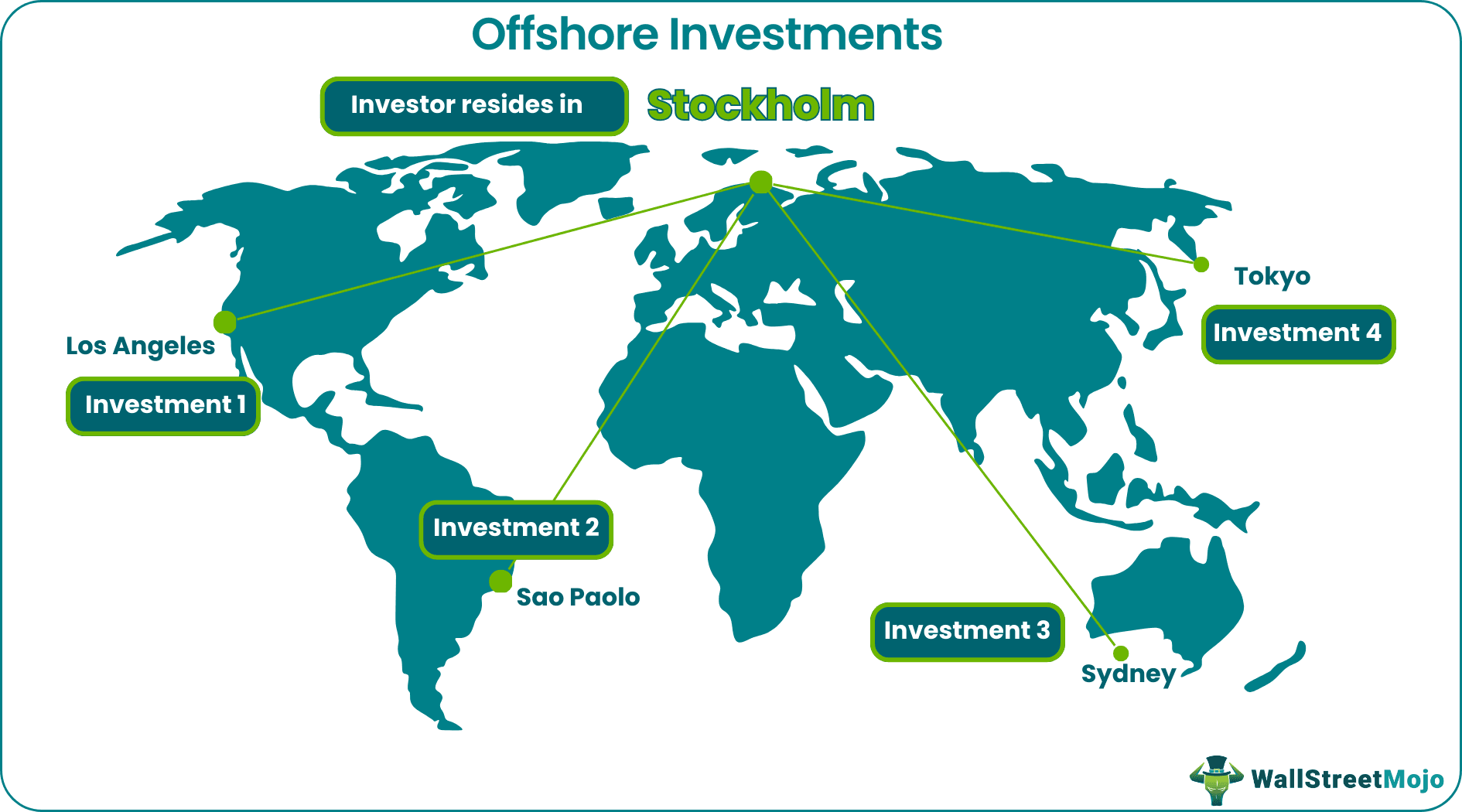

Understanding overseas investment entails acknowledging the critical advantages it uses to individuals and companies looking for to maximize their financial profiles. Offshore financial investments normally describe assets kept in an international jurisdiction, commonly identified by positive tax obligation regimes, regulative settings, and privacy protections. The main purpose behind such investments is to enhance resources diversification, danger, and development monitoring.

Investors can access a wide variety of economic tools with offshore locations, including stocks, bonds, common funds, and property. These investments are usually structured to adhere to regional laws while offering adaptability in terms of property appropriation. Additionally, offshore financial investment approaches can make it possible for people and services to hedge versus residential market volatility and geopolitical threats.

An additional secret facet of offshore financial investment is the potential for improved personal privacy. An extensive understanding of both the advantages and obligations connected with overseas investments is vital for educated decision-making.

Benefits of Offshore Investing

Capitalists often transform to offshore spending for its numerous benefits, consisting of tax obligation efficiency, possession security, and profile diversification. One of the primary advantages is the potential for tax optimization. Lots of overseas territories provide desirable tax programs, enabling capitalists to legitimately reduce their tax liabilities and make best use of returns on their financial investments.

Additionally, offshore accounts can provide a layer of asset protection. Offshore Investment. By putting possessions in politically steady jurisdictions with strong privacy laws, investors can safeguard their wealth from potential legal claims, creditors, or financial instability in their home nations. This kind of security is particularly appealing to high-net-worth individuals and business owners encountering lawsuits threats

In addition, overseas investing assists in portfolio diversification. Accessing international markets allows capitalists to discover chances in different asset classes, including actual estate, supplies, and bonds, which may not be available domestically. This diversity can minimize general portfolio threat and enhance potential returns.

Eventually, the benefits of overseas investing are compelling for those looking for to enhance their financial methods. Nonetheless, it is important for investors to completely understand the laws and ramifications connected with offshore investments to ensure conformity and achieve their monetary goals.

Selecting the Right Jurisdiction

Picking the appropriate territory for overseas investing is a vital choice that can considerably affect a capitalist's financial method. The appropriate jurisdiction can provide different benefits, consisting of beneficial tax structures, possession defense regulations, and regulatory atmospheres that line up with a capitalist's goals.

When selecting a jurisdiction, think about variables such as the political security and financial health of the country, as these elements can impact financial investment security and returns. The lawful structure surrounding foreign financial investments must be examined to make certain conformity and defense of properties. Nations understood for durable legal systems and transparency, like Singapore or Switzerland, frequently instill higher confidence among investors.

Additionally, assess the tax effects of the territory. Some nations provide eye-catching tax incentives, while others may enforce strict reporting needs. Comprehending these subtleties can aid in enhancing tax obligation liabilities.

Steps to Establish an Offshore Account

Establishing an offshore account entails a series of methodical actions that ensure compliance and protection. The primary step is choosing a reliable overseas economic institution, which must be accredited and regulated in its jurisdiction. Conduct complete study to examine the institution's reputation, services provided, and client testimonials.

Following, collect the necessary paperwork, which commonly consists of identification, evidence of address, and info pertaining to the resource of funds. Different jurisdictions may have varying requirements, so it is important to verify what is required.

As soon as the documentation is prepared, initiate the application process. This may involve filling up out types on the internet or face to face, relying on the establishment's methods. Be planned for a due persistance process where the bank will certainly verify your identification and analyze any kind of possible threats connected with your account.

After authorization, you will certainly obtain your read here account details, allowing you to fund your overseas account. It is advisable to maintain clear documents of all purchases and adhere to tax obligation guidelines in your home country. Developing the account appropriately establishes the foundation for effective overseas financial investment administration in the future.

Handling and Monitoring Your Investments

Once an overseas account is efficiently established, the emphasis changes to handling and monitoring your financial investments properly. This essential stage involves a systematic approach to guarantee your possessions align with your monetary goals and risk tolerance.

Begin by establishing a clear investment strategy that describes your goals, whether they are capital preservation, revenue generation, or growth. Frequently review your profile's performance versus these standards to examine whether adjustments are required. Utilizing financial monitoring tools and systems can help with real-time monitoring of your investments, giving insights right into market trends and property allowance.

Involving with your offshore financial consultant is vital. They can use know-how and assistance, aiding you navigate complicated regulatory atmospheres and global markets. Schedule routine testimonials to discuss performance, analyze market conditions, and alter your method as necessary.

Additionally, continue to be informed about geopolitical growths and financial indicators that may affect your financial investments. This aggressive approach enables you to respond quickly to transforming circumstances, ensuring your offshore profile continues to be durable and aligned with your investment goals. Eventually, thorough monitoring and ongoing tracking are necessary for optimizing the advantages of your overseas financial investment approach.

Verdict

In verdict, offshore investment offers a calculated method for portfolio diversification and risk monitoring. Continued monitoring and cooperation with monetary advisors remain essential for keeping a nimble financial investment strategy in an ever-evolving international landscape.

Offshore investment offers a structured path for financiers looking for to enhance their economic methods while leveraging international chances.Recognizing offshore financial investment involves acknowledging the strategic benefits it supplies to corporations and people looking for you can check here to enhance their economic portfolios. Offshore financial investments typically refer to properties held in a foreign territory, frequently defined by favorable tax regimens, regulatory atmospheres, and personal privacy defenses. Additionally, overseas financial investment techniques can allow people and businesses to hedge versus residential market volatility and geopolitical risks.

Report this page